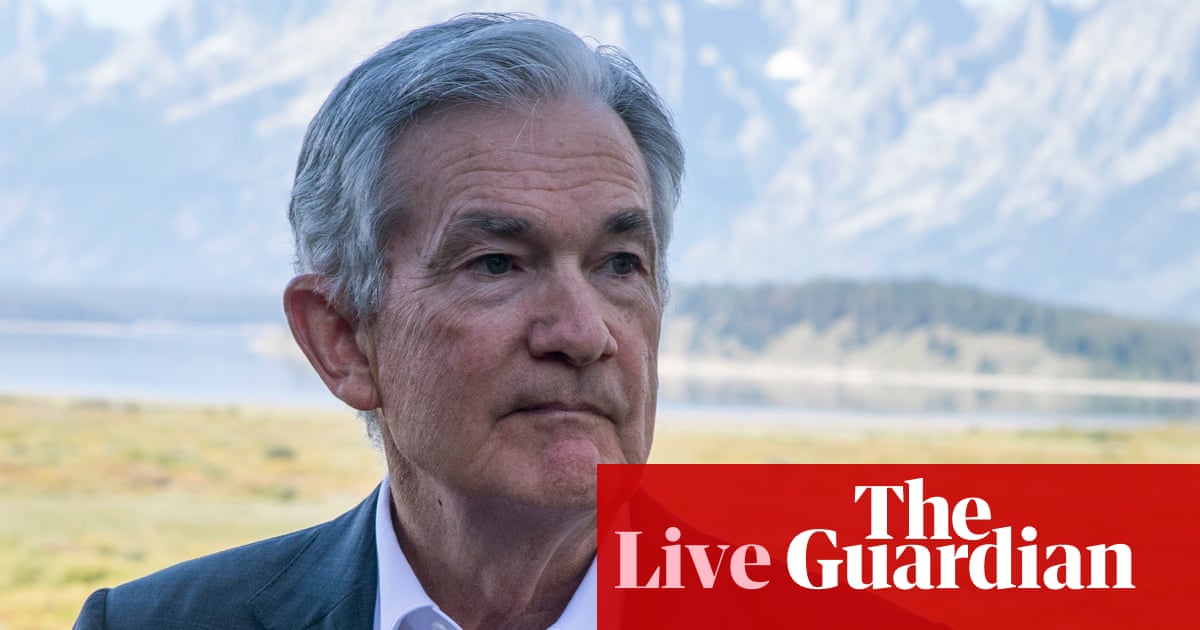

Powell: The time has come for interest rate cuts

Jerome Powell says:

The time has come for policy to adjust. The direction of travel is clear and the timing and pace of rate cuts will depend on incoming data.

Key events

Could a 0.5 percentage point (50 basis points) cut be in play in September after what International Financing Review described as Powell’s “forceful tone”?

Stephen Brown, deputy chief North America economist at Capital Economics, a consultancy, said:

Fed Chair Jerome Powell’s dovish tone at Jackson Hole today and pledge to do “everything we can to support a strong labour market” implies that a 50 basis point cut could be on the table at the September meeting, although such a move might require a further rise in the unemployment rate in the August employment report, which we judge to be unlikely.

In an unmistakably dovish speech, Powell focused on the near-term outlook for policy in the context of the recent weak July Employment Report. While Powell noted that “rising unemployment has not been the result of elevated layoffs, as is typically the case in an economic downturn”, he stressed that “the cooling in labor market conditions is unmistakable” and that “we do not seek or welcome further cooling in labor market conditions”.

Recognising the risks of a further rise in the unemployment rate, Powell noted that the “current level of our policy rate gives us ample room to respond” and that “we will do everything we can to support a strong labour market”. Given that the July meeting minutes released this week explicitly mentioned the potential for a 25 bp cut, the lack of any guidance on the size of the move next month suggests that Powell is keeping his options open, simply noting that the “pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Investors have also snapped up bonds, pushing up their prices.

The yield on the US 10-year Treasury, which moves inversely to prices, fell by six basis points (hundredths of a percentage point). UK gilt yields also fell.

Wall Street stocks gained throughout the speech, with the S&P 500 up by 1% in the minutes after Powell finished.

The tech-focused Nasdaq is up by 1.4%, while the Dow Jones industrial average has also gained 1%.

The US dollar has dipped, stocks have jumped, and bond yields have fallen as markets read that speech as dovish.

The dollar is down by 0.45% against a trade-weighted basked of currencies.

Powell says:

That is my assessment of events. Your mileage may differ.

The pandemic was an extraordinary situation, Powell says. There is a lot still to learn that will require humility in a review of past policy.

And with that, the speech is over.

It was far from assured that the inflation anchor would hold, Powell says.

Anchored inflation expectations can facilitate disinflation without the need for slack, he says – in comments that suggest he thinks a “soft landing” without a recession is possible.

The fall in inflation – without a sharp rise in unemployment – has been very welcome, Powell says.

The unwinding of inflationary factors took longer than expected, but it did eventually happen. He says:

The labour market … is no longer a source of inflationary pressures.

The global nature of inflation that followed in 2022 – thanks in part to Russia’s invasion of Ukraine – was unlike anything seen since the 1970s, Powell says.

The Federal Reserve was “utterly committed to avoiding” the long-lasting inflation of the 1970s.

Some people said a recession would be required to fight inflation in 2022.

Now Powell is laying out the post-pandemic economic situation.

The pandemic wreaked havoc on the labour market, Powell says. It did not return to its pre-pandemic trend until mid-2023.

Inflation spiked in 2021 with “extremely large” increases in prices from products in short supply such as cars. Those spikes were expected to be transitory. He says

The good ship transitory was a crowded one … I think I see some former shipmates out there today.

The case for the transitory inflation theory “turned hard”, requiring a strong response from the Federal Reserve in late 2021 going into March 2022.

Powell: The time has come for interest rate cuts

Jerome Powell says:

The time has come for policy to adjust. The direction of travel is clear and the timing and pace of rate cuts will depend on incoming data.

Powell says:

My confidence has grown that inflation is on a sustainable path back to 2%.

There has been a slowdown from the previous frantic conditions in the labour market, and labour market conditions are less tight than in 2019, before the coronavirus pandemic.

The labour market has cooled considerably from its formerly overheated state.

We do not seek or welcome further cooling in labour market conditions.

Jerome Powell: We have made progress in fighting inflation

Jerome Powell has started speaking at Jackson Hole.

The worst of the pandemic distortions are fading, he says. Supply constraints have normalised.

The task is not complete, we have made a good deal of progress.

Here is an interesting chart from Reuters. It shows that Jerome Powell’s speeches at Jackson Hole have for the most part reassured stock market investors – but twice they have prompted big declines.

The most notable decline came in 2022, when Powell warned that the fight againt inflation – at that time rising because of coronavirus pandemic disruption – would cause “pain” for Americans.

The big decline in 2022 drags down the average performance of the S&P 500 on the day of the speech to a decline of 0.6%.

Wall Street has opened, and with less than half an hour to go until the closely watched speech from Jerome Powell, US stock markets are apparently positioning for a dovish Fed that will support the economy.

Here are the opening snaps, via Reuters:

-

S&P 500 UP 33.95 POINTS, OR 0.61 %, AT 5,604.59

-

NASDAQ UP 153.60 POINTS, OR 0.87%, AT 17,772.95

-

DOW JONES UP 180.12 POINTS, OR 0.44%, AT 40,892.90

The time in Jackson Hole is not yet 7:30am, but it appears that monetary policy fans are up with the lark.

The European Central Bank has already cut interest rates once, back in June, but it is lining up for another in September. Reuters reports that unnamed sources have indicated that a September cut is likely.

Reuters wrote that:

A growing number of European Central Bank policymakers are lining up behind another interest rate cut in September and only major data surprises in the coming weeks could delay the move, on and off record conversations with seven sources indicate.

… other sources, who declined to be named, said private, informal conversations are showing broad support for the move, even if most are still awaiting further data before finalising their views.

Investors have grown more sceptical in recent days of the prospects for a 0.5 percentage point cut from the Federal Reserve, according to Henry Allen, a strategist at Deutsche Bank.

He wrote:

For investors, the big question is to what extent Powell validates expectations for a September rate cut, and whether he offers any indication of how big any rate cut might be. Last year, Powell said that they intended “to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective”. But over the following 12 months, we’ve seen inflation experience a noticeable decline, along with an increase in unemployment. So from both sides of the Fed’s dual mandate, we’ve moved much closer to a point where the Fed have cut rates in previous cycles.

Our US economists’ view is that it will be difficult for Powell to pre-commit to a particular trajectory at Jackson Hole. But they do think his comments will imply that the Fed can begin dialling back the degree of restraint soon, opening the door to a rate cut next month.

Allen also highlighted several messages from Fed officials which suggest they are not on the warpath for a 0.5 percentage point cut:

Boston Fed President Collins said that she didn’t see any “big red flags”, and Philadelphia Fed President Harker said that “I think a slow, methodical approach down is the right way to go”. Meanwhile, Kansas City Fed President Schmid said that he wanted to see more data, saying that “Before we act — at least before I act, or recommend acting — I think we need to see a little bit more.”

Coming up: Jerome Powell’s speech to the Jackson Hole summit

What do we have in store later (3pm BST; 10am EDT) when Jerome Powell addresses the annual central bankers’ convention at Jackson Hole, a mountain resort in Wyoming? Economists are expecting that the Federal Reserve president will avoid rocking the boat.

The Jackson Hole summit is a chance for central bankers to deliver messages during the quietest month. But this summer the consensus is firmly that the Fed will deliver its first interest rate cut since the start of the coronavirus pandemic in March 2020.

Market transactions imply a 71.5% chance that the Federal Reserve cuts interest rates from the current range of 5.25% to 5.5% at the next meeting of its rate-setting Federal Open Markets Committee (FOMC), according to CME Group’s FedWatch tool.

The tool, based on financial derivatives, suggests that a September cut is a certainty, with a 28.5% chance of a 0.5 percentage point cut.

The key question now for investors will be the pace of the cutting in the months to come.

Bob Savage, head of markets strategy and insights at BNY Mellon, a US investment bank, said it was “Risk on as markets are prepared for a dovish Fed Powell”. Investors have bought up riskier stocks and are positioning for the carry trade (borrowing in lower-yielding dollars and investing in other, higher-yielding currencies), in the belief that Powell will seek to support the economy with looser monetary policy. Looser monetary policy tends to hit the value of the home currency. Savage said:

The risk for today rests on how markets interpret the FOMC Powell speech. The positioning into the event has been clear – shedding USD for EUR and GBP, buying carry trades in [foreign exchange], while owning more bonds and stocks.

James Knightley, an economist at ING, a Dutch investment bank, said that the Fed had firmly signalled that it will cut in September. He will be on the lookout for Powell giving any signs that he is considering cutting more firmly if economic data are weaker. He said:

Recent downward revisions to nonfarm payrolls and a dovish set of minutes to the July Federal Reserve FOMC meeting where “the vast majority” of members thought it “would likely be appropriate” to cut interest rates in September, have firmed up expectations that lower borrowing costs are on their way. We currently have a 50bp cut in our projections, but the Fed appears cautious on cutting rates aggressively and it would likely take a very soft jobs report on 6 September to generate such an outcome.